Video

Download Presentation PDF

Questions & Answers

Modified Adjusted Gross Income (MAGI) is used to determine your eligibility for subsidies through the Health Connector. More information and a form to assist you in calculating your annual projected income can be found below.

Questions in the application will guide you through the information that you need to supply. In general, we recommend that you read the tooltips in the application if you have questions. It’s also helpful to have a copy of your most recent tax return handy so that you can compare your income or account for deductions that you might also have for 2020.

Get full details at https://www.mahealthconnector.org/how-do-i-answer-questions-about-income

When estimating your yearly/annual income, combine the income you earned in 2020 prior to becoming unemployed with your weekly unemployment benefit amount for the duration of the expected unemployed period (up to 39 weeks).

If you think you are returning to work, include the amount that you expect to earn for the remainder of the year.

The table and tips below can help you know what needs to be included or not when answering the current income question and the yearly income questions in the online application.

- If you are applying for the first time, or a current Health Connector or MassHealth member updating your income, you may have new types of income, which you might be unsure of how to enter, including Unemployment Income

- One-time, federal “recovery rebate” or “stimulus payment” ($1,200 per adult and $500 per qualifying child)

When filling out your income information, use the chart below to help complete your application:

| Type of Income | Include in Current Income? | Include in Projected Annual Income? |

|---|---|---|

| Unemployment extension to up to 39 weeks of benefits | Yes, regular unemployment should be reported as long as it is received | Yes, make your best prediction about your yearly income accounting for how long you expect to receive unemployment |

| $600 unemployment “bump” (Federal Pandemic Unemployment Compensation) | No, do not include this amount in the unemployment benefits you report | Yes! Do add the $600 per week in when reporting expected yearly income. Someone on unemployment from early April through July 31 will earn about $10,000 from this bump |

| One-time “recovery rebate” or “stimulus payment” of $1200 per adult and $500 per qualifying child | No, do not include this income | No, do not include this income |

Tips for entering income:

- If you are applying or updating your income, you should enter your current income (as it is right now), then update your expected yearly income based on what you think you’ll make over the course of the year

- When entering your yearly income, consider how much has been earned so far this year, add any unemployment, including the extra $600 per week you may have received until this benefit expired, and include what might be earned if and when you return to work later this year

- If your income changes later, update your income information again so it is as correct as possible

- If you qualify for an Advance Premium Tax Credit (APTC), you can always adjust the amount you take by using the slide on the Eligibility Results page of your application

- The IRS will determine your final premium tax credit amount based on your income when you file your 2020 taxes. You may receive more tax credits or have to pay some back, depending on how your estimated income compares to your actual income. If you are unsure of your income and think that your income might end up being higher than you initially reported on your application, you can lower the amount of Advance Premium Tax Credit (APTC) that you want to take to help protect yourself from owing money at the end of the year when you file your taxes.

-

- You can lower your APTC amount in your online account at MAhealthconnector.org or by calling Health Connector Customer Service. Learn more at: https://www.mahealthconnector.org/help-center-answers/change-the-amount-of-aptc-you-use

Find this information and more about income at https://www.mahealthconnector.org/how-do-i-answer-questions-about-income

Generally, for the Health Connector you should include on your application anyone in your tax filing household whether or not they need health insurance. Since access to financial help comes in the form of state subsidies + federal advance premium tax credits, it’s important that you tell us about everyone in your tax filing household so you get the most accurate amount of financial help.

You can find a full list of people you can include in your application at https://www.mahealthconnector.org/help-center-answers/people-to-include-when-applying

If your income is over 400% FPL the Health Connector serves as a Marketplace for plans offered from the leading health insurance carriers in the state. The Health Connector offers individuals and families an opportunity to compare plans side-by-side and shop for a plan that meets your needs. Those shopping through the Health Connector can rest assured that all plans meet state and federal standards.

If your tax credit is $0, this means there is no difference between the amount that the federal government has determined you can afford, and the amount of the premium for the second lowest-cost Silver plan available for you through the Health Connector (see “How is a tax credit calculated?” above). For example, if the Health Connector has determined that you should be able to afford $100 per month in health insurance based on the Affordable Care Act rules, and the premium for the second lowest-cost Silver plan available is $100 per month or less, then your tax credit amount would $0.

Learn more about why you may not qualify for subsidies at https://www.mahealthconnector.org/help-center-answers/why-dont-i-qualify-for-subsidies

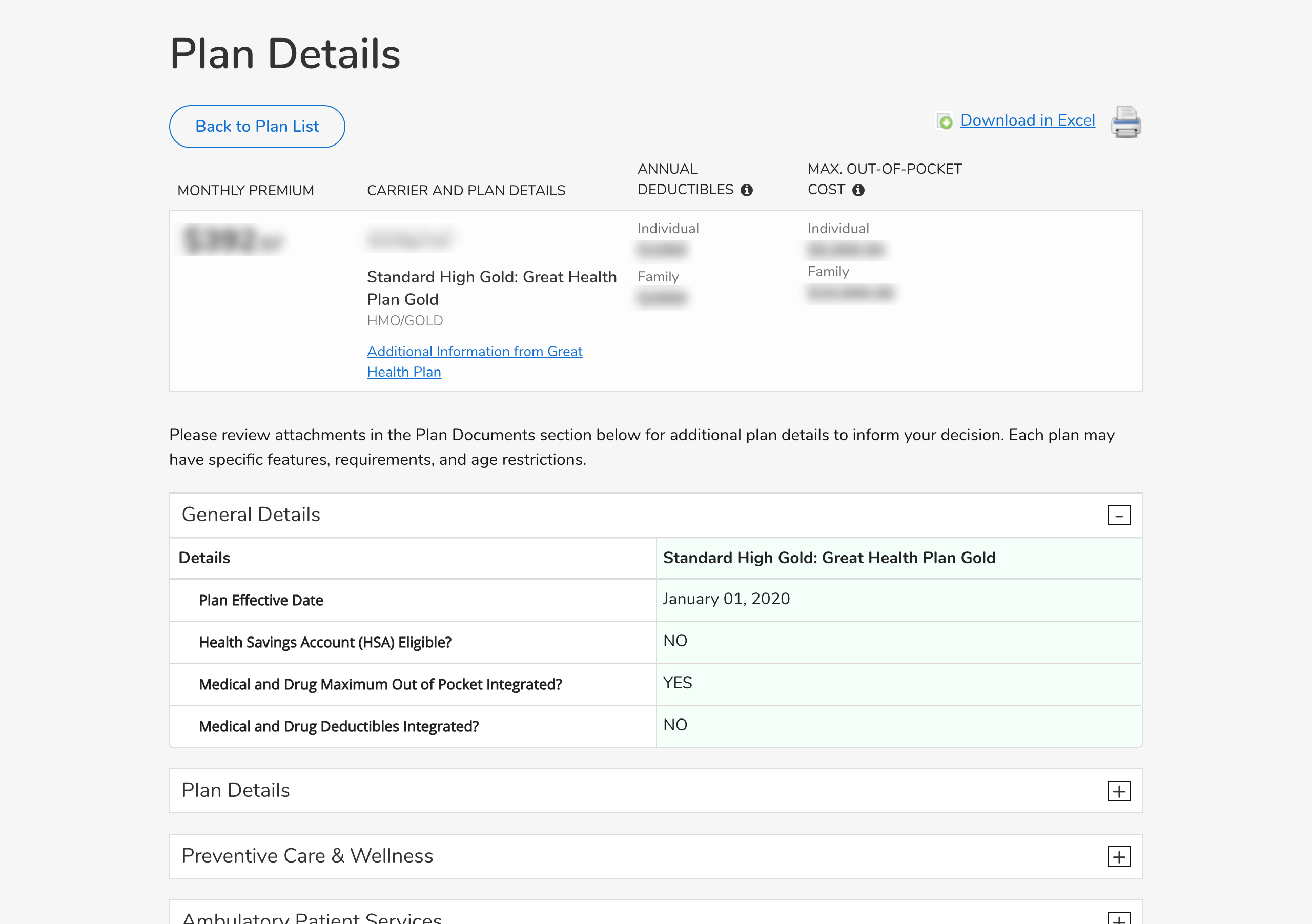

Yes, the Health Connector does offer access to some plans that are HSA compatible. Information about whether or not a plan is HSA compatible can be found on our website. When reviewing a particular plan, look at the “Plan Details” and then see HSA eligible under “General Details”. While the Health Connector offers some HSA-compatible plans, it does not offer Health Savings Accounts; individuals would need to establish those separately.

Information about all changes in circumstances, including those that lead to a loss of minimum essential coverage can be found here: https://www.mahealthconnector.org/get-started/special-enrollment-period

Navigators are trusted community-based organizations that receive grants and training through the Health Connector to help people in their communities in navigating the health care landscape. This work includes answering questions about health care coverage, assisting individuals with applying for health insurance coverage, enrolling in health insurance coverage and updating applications when directed to do so by an individual. Navigators provide help in multiple languages and are located around the state to provide assistance in their communities.

When a person works with a Navigator, that Navigator will be documented on the Health Connector account for future reference and assistance. Navigators are able to make updates to applications at the direction of individuals, and do not make a commission based on enrollments.

To see a full list of local Navigators, go to https://www.mahealthconnector.org/here-to-help.

Additional Resources

- Health Connector homepage, www.MAhealthconnector.org

- Resource download page (Shopping Guides, Guide to Subsidies, ConnectorCare Overview, Standardized QHPs)

- Health Connector Provider and Prescription search tool

- Enrollment Assistance search

- Customer service information (call and walk-in centers)

- Small Business page

- Coverage options for non-benefits eligible employees or former employees

- Resources for newly unemployed: