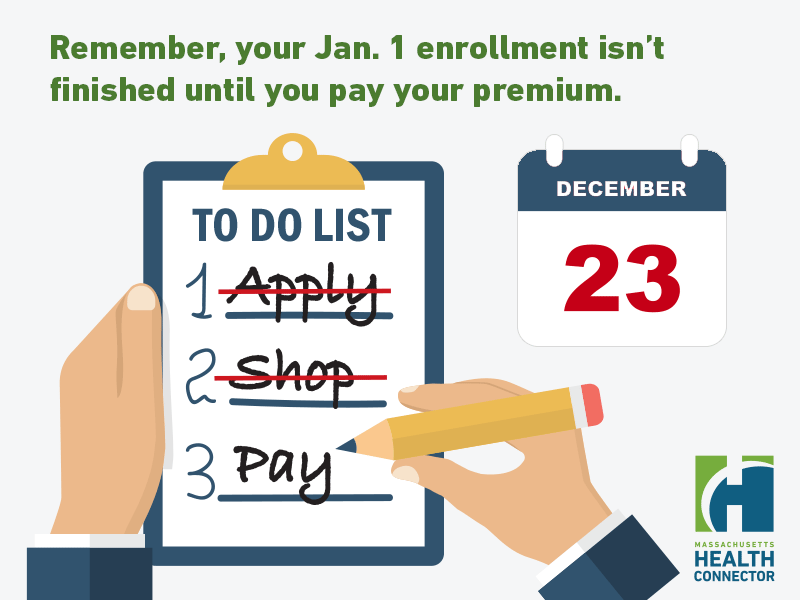

Massachusetts residents have until Dec. 23 to get covered and #StayCovered for Jan. 1, 2019, coverage

BOSTON – December 10, 2018 – Massachusetts residents who do not have health insurance or need to take action to #StayCovered have until Dec. 23 to enroll or renew coverage through the Massachusetts Health Connector, which holds Open Enrollment longer than the federal government. Open Enrollment in Massachusetts extends through Jan. 23 in Massachusetts, for those who obtain coverage starting in February 2019. Massachusetts residents can go to MAhealthconnector.org to apply and pick a plan. “Dec. 23 is an important deadline for people in Massachusetts who need to get covered or stay covered for the start of the New Year, and we want people to know they have an extra week compared to the federal deadline” said Louis Gutierrez, the Executive Director of the Massachusetts Health Connector. “We want everyone in Massachusetts to have access to affordable health care, and we want to extend every opportunity for residents to sign up or maintain their coverage.” As of Dec. 3, more than 261,000 were already enrolled for coverage starting Jan. 1, 2019. Members or applicants who need help finding coverage for next year can go to the Health Connector website and find a local organization with trained assisters who can help. Included are 16 Navigator organizations across the state, who have 94 individuals available to help, providing assistance in 15 languages. Along with reaching out to the state’s uninsured population through a series of community-based outreach and marketing efforts, the Health Connector is also encouraging people who already have insurance to [...]