Calculating your Modified Adjusted Gross Income (MAGI)

To help figure out your annual Modified Adjusted Gross Income (MAGI) income for 2025, we have provided the calculator below. Please note that the all sources of income you expect to receive in 2025 must be considered. For example, if you are a seasonal employee and expects to collect unemployment during certain months of the year, you should include the expected unemployment income in the total income.

[ninja_forms id=34]

How to answer questions about your current income

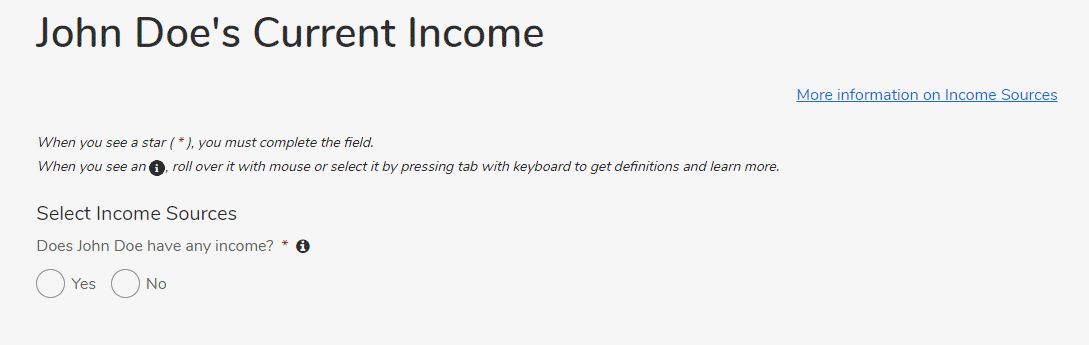

The question “Does FIRST NAME LAST NAME have any income?” should be answered for the MONTH you are completing your application. If you—and any household members included on your application—has any current income (such as income from a job, self-employment, or other source), the answer should be “Yes”.

If you answer the question by selecting “No”, click “Save and Continue” to move to the next page.

Answer this question based on your current income.

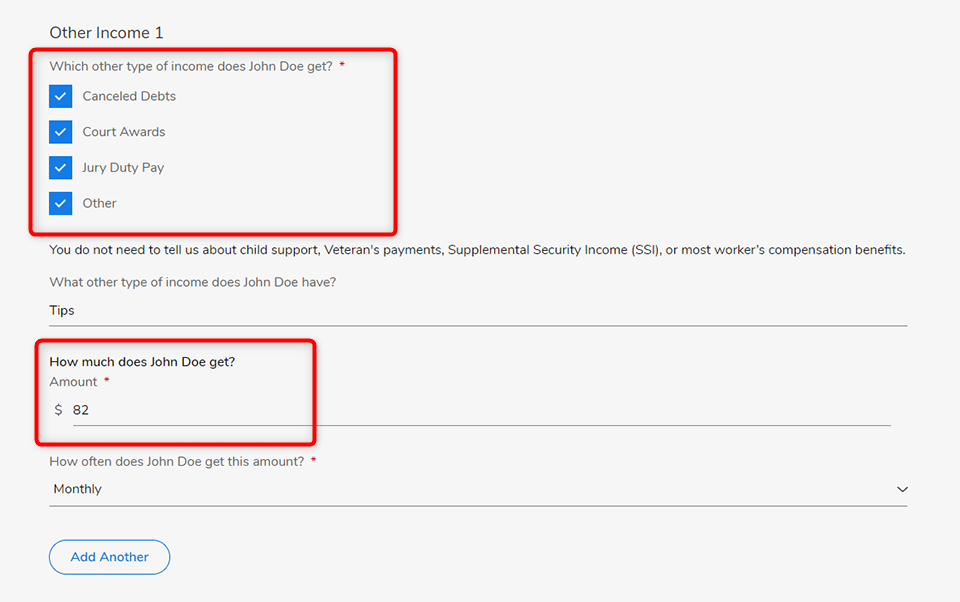

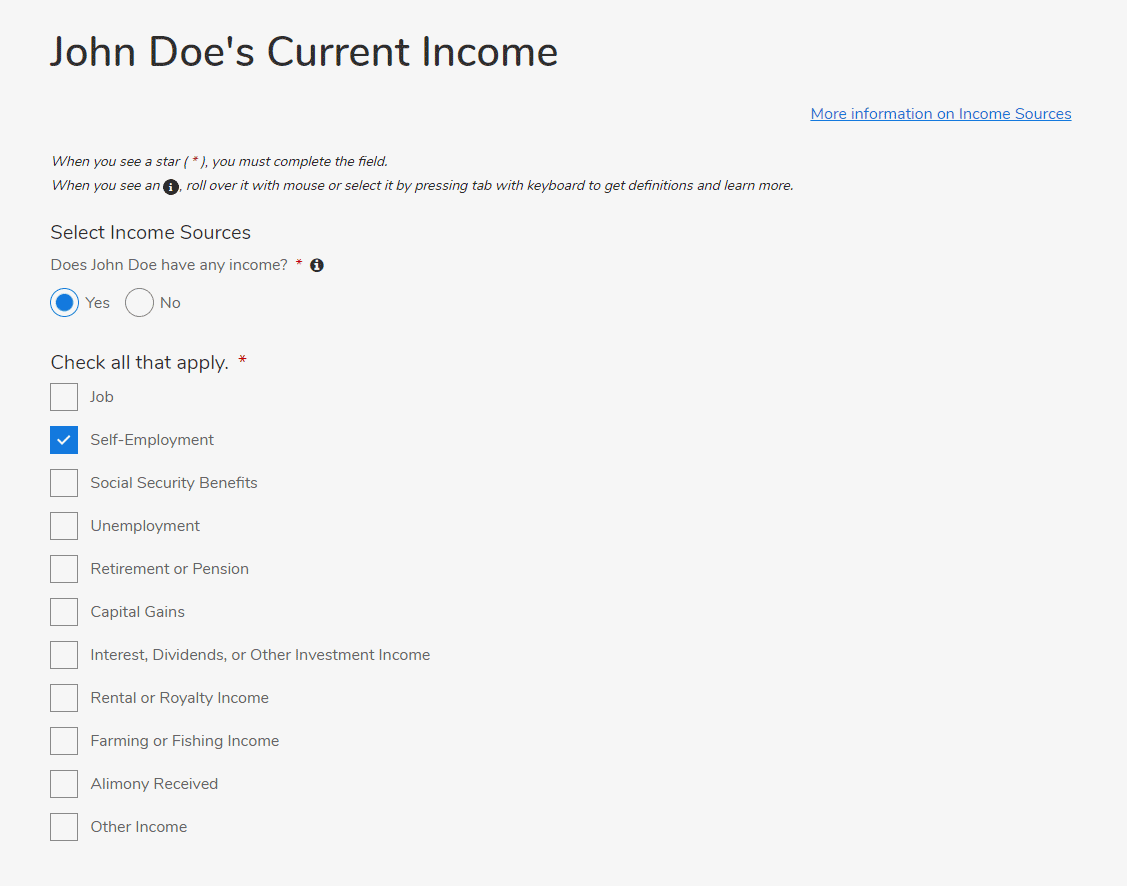

If you answer the question by selecting “Yes”, the next question on the screen will ask what types of income you have. You can check all the boxes that apply and then click “Save and Continue” to move to the next page and answer questions about the type(s) of income you checked.

Check all income types that apply to you.

Income Frequency

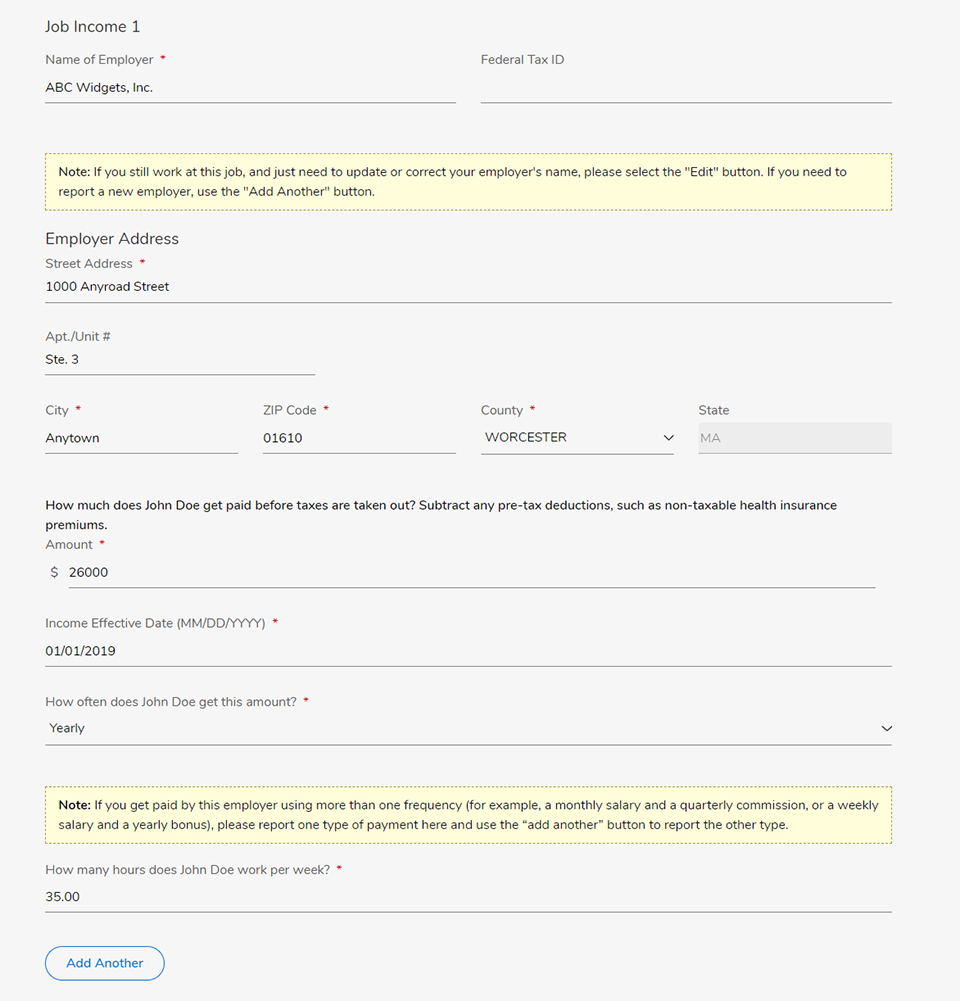

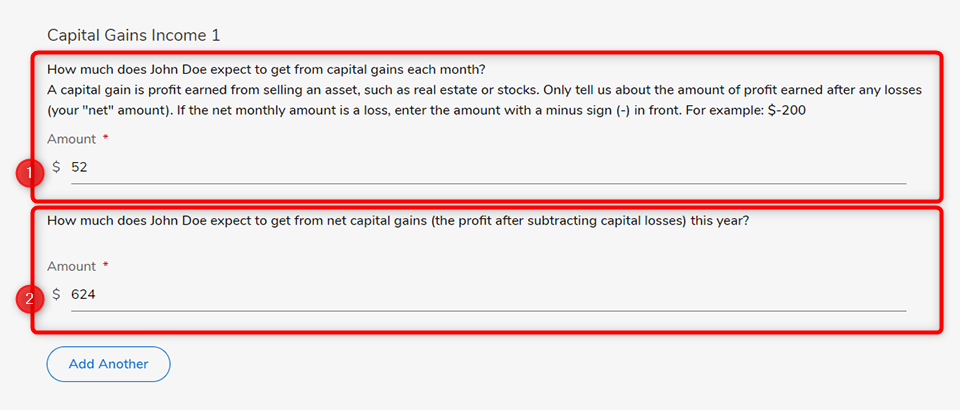

Take care to note that the income amount has the right frequency (how often you receive the income). The table below includes frequency choices and descriptions you will need to know as you are filling out your income information.

| Frequency | Description |

|---|---|

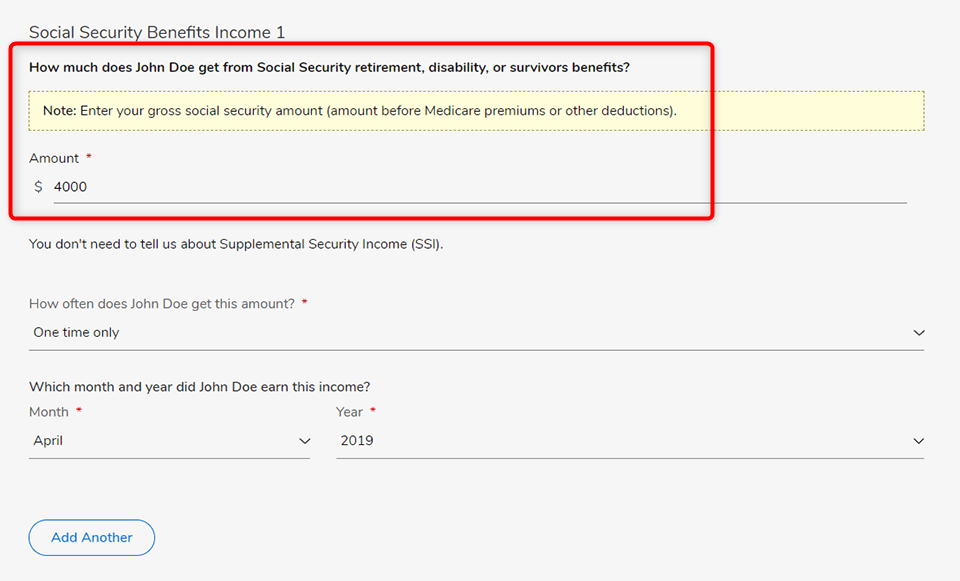

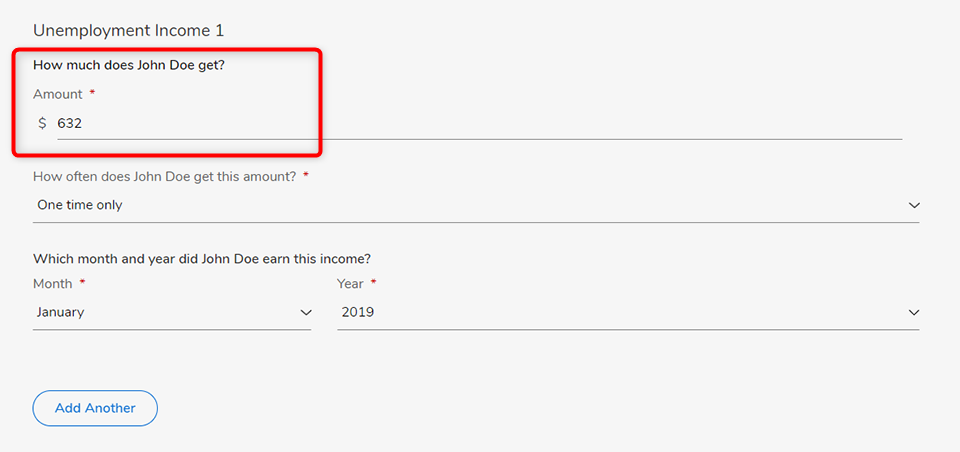

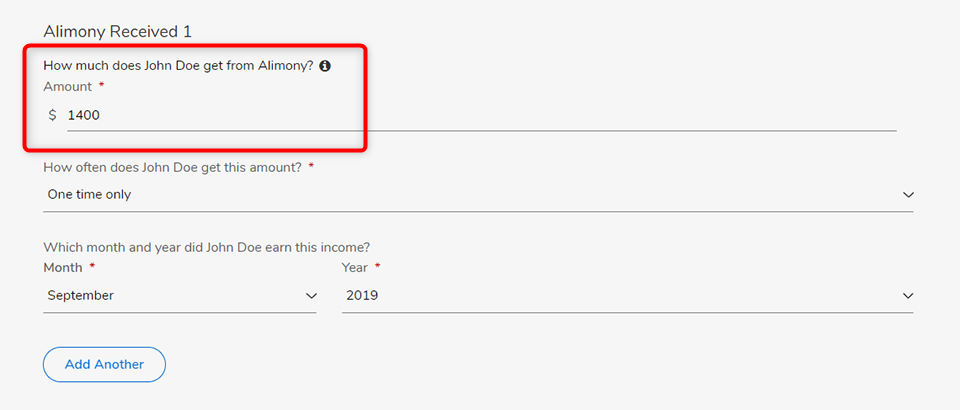

| One time only | This means income you expect to receive only once in the year. For example, jury duty pay, a one-time bonus payment, or a one-time contract that was completed. If you choose this option, you would need to select which month you received the income. |

| Weekly | This means you receive the amount of income you enter once each week. |

| Every two weeks | This means you receive the amount of income you enter every 2 weeks (or every other week). This is also known as bi-weekly. |

| Twice a month | This means you receive the amount of income you enter twice a month, usually on a certain schedule, like the 1st and 3rd Friday of the month, or the 1st and 15th day of the month. |

| Monthly | This means you receive the amount of income you enter once a month. |

| Every other month | This means you receive the amount of income you enter every 2 months. For example, if you are paid in January, you will skip February, and won’t be paid again until March. |

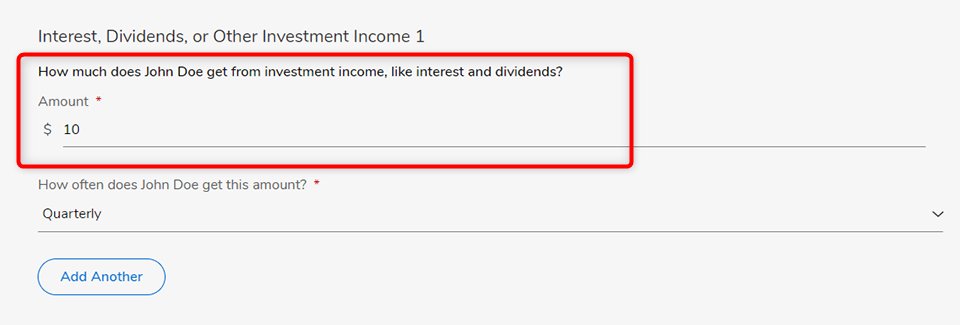

| Quarterly | This means you receive the amount of income you enter every 3 months (or a total of 4 times per year.) For example, if you are paid in January, you will skip February and March, and won’t be paid again until April. |

| Twice a year | This means you receive the amount of income you enter 2 times within the entire year (or every 6 months, for example in January and July). |

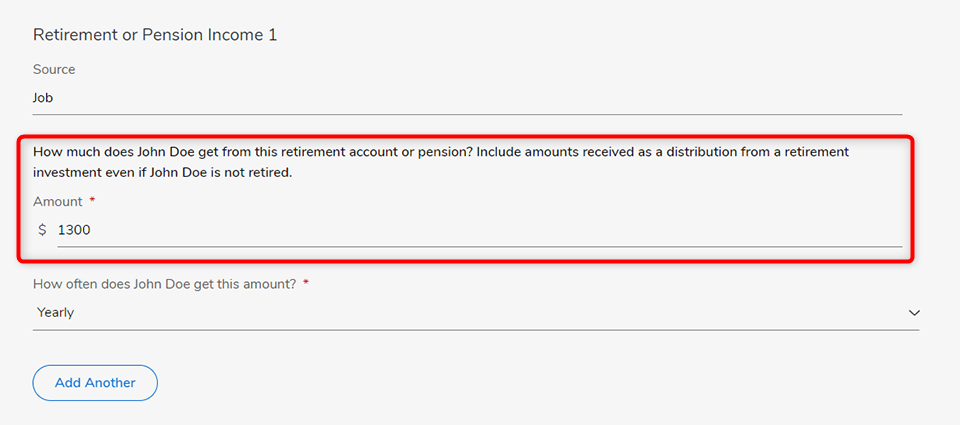

| Yearly | This means the amount of income you enter is the total amount you received from that source for the entire year. You can select this option even if you receive a steady income at a different frequency, such as weekly, but prefer just to enter your whole yearly (or annual) income from a source, if you know it. |

| Seasonally | This means you receive the amount of income you enter only certain parts of the year (during a season, such as a summer job, for example). If you choose this option, you would need to select which month(s) you received the income. |

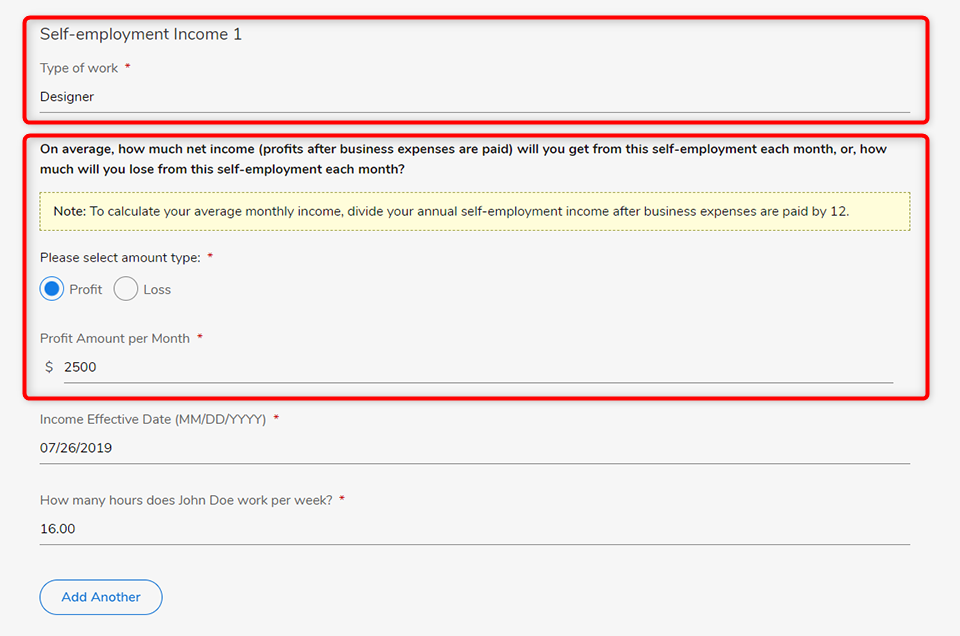

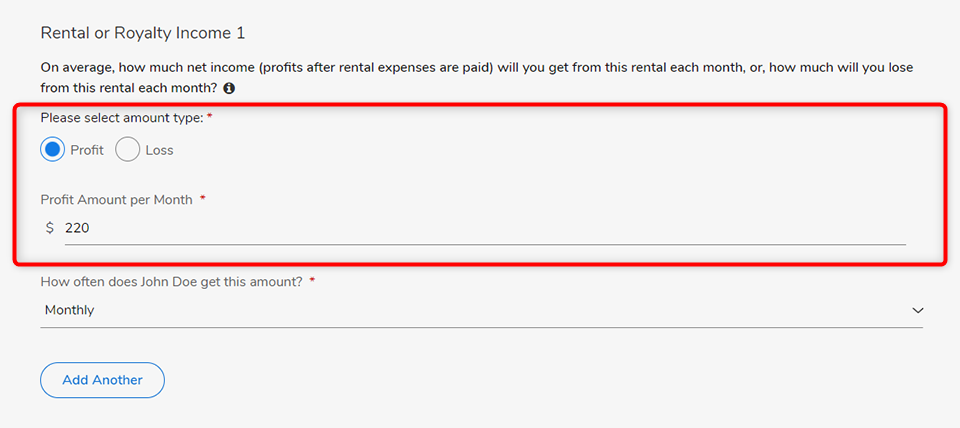

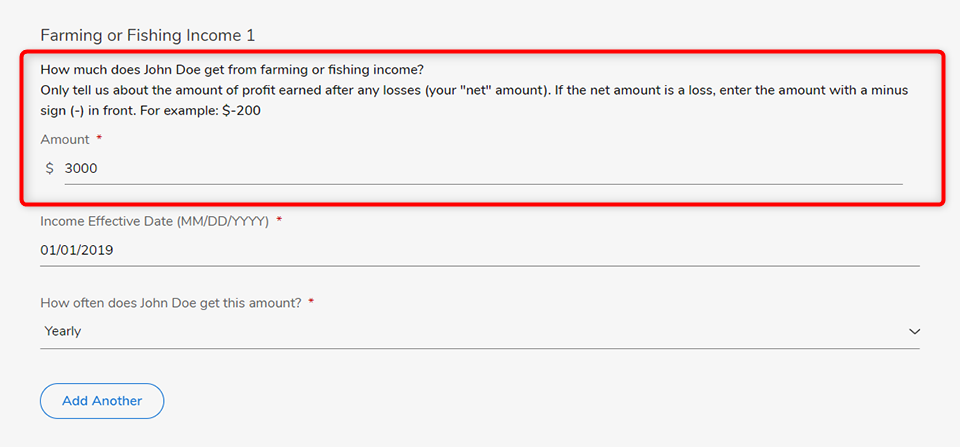

Enter your income information

Click on an income type below for help answering the question on your application.

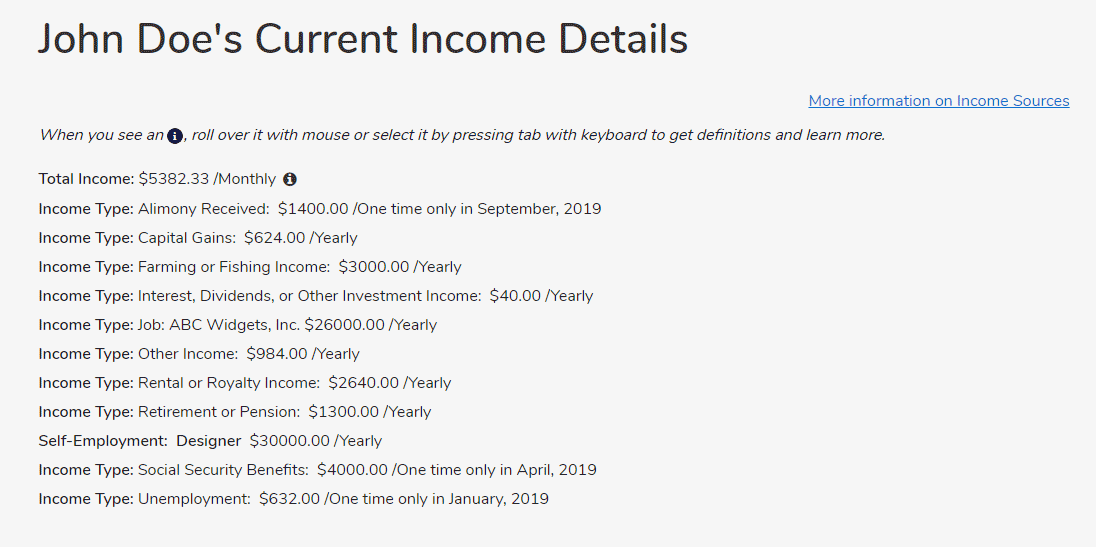

Current Income Details

The “Current Income Details” screen lists the person’s current monthly income based on information entered on the previous screens. The monthly income will be used to calculate eligibility for MassHealth, Health Safety Net (HSN), and Children’s Medical Security Plan (CMSP).

Deductions

Certain deductions can lower the income used to calculate eligibility. You should ONLY include deductions that are allowed to be deducted on your federal income tax return. Allowable deductions on the federal income tax return include the following:

- Educator expenses

- Certain business expenses of reservists, performing artists, and fee-basis government officials

- Health savings account deduction

- Moving expenses

- Deductible part of self-employment tax

- Self-employed SEP, SIMPLE, and qualified plans

- Self-employed health insurance deduction

- Penalty on early withdrawal of savings

- Alimony paid

- IRA deduction

- Student loan interest deduction

- Tuition and fees

- Domestic production activities deduction

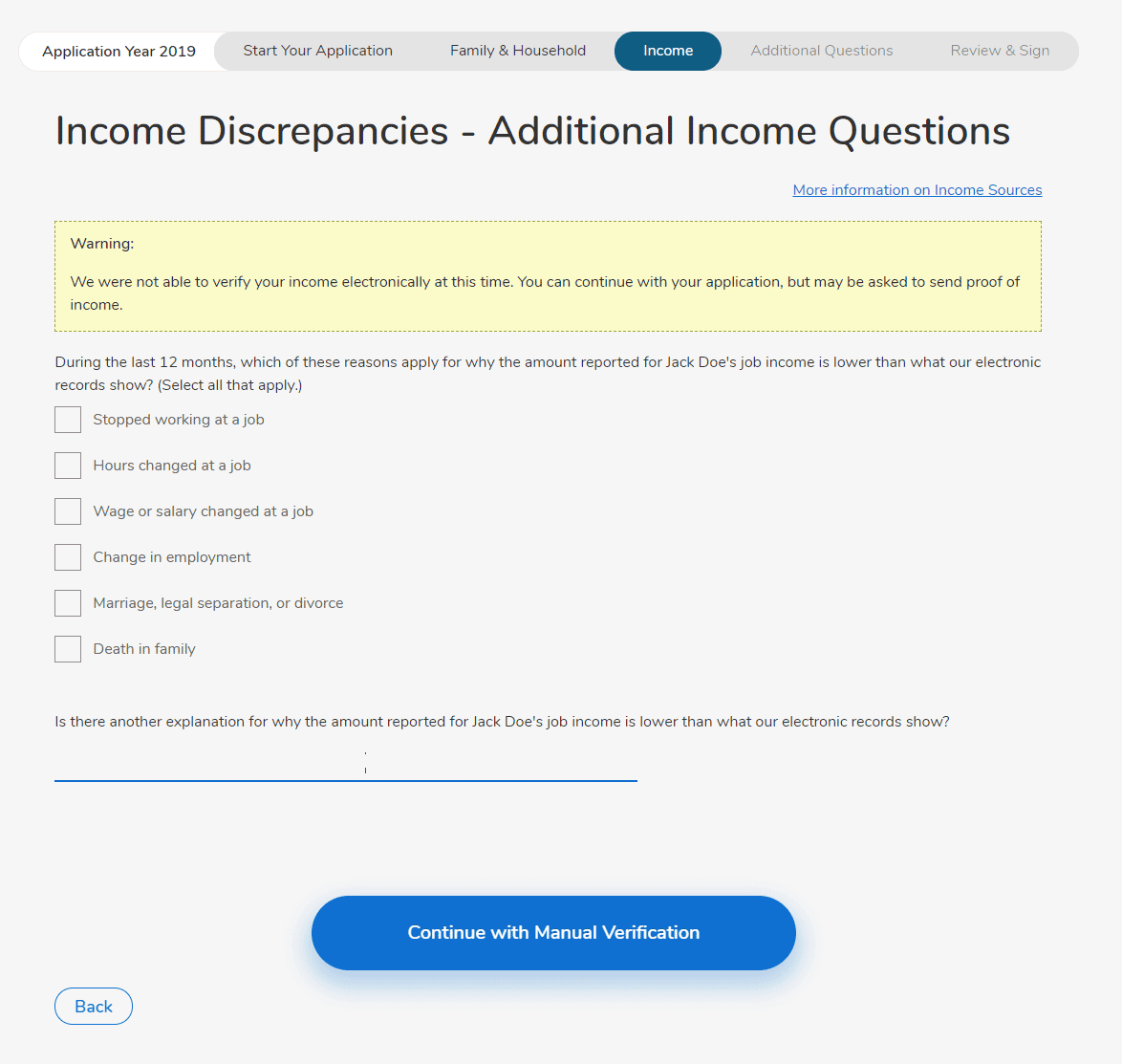

Income Discrepancies

If there is a difference between the total current income provided on the application and the available data we will ask the applicant to provide a reason for the discrepancy. This section does not impact eligibility. If verification is required, we will ask for documents at the end of the application.

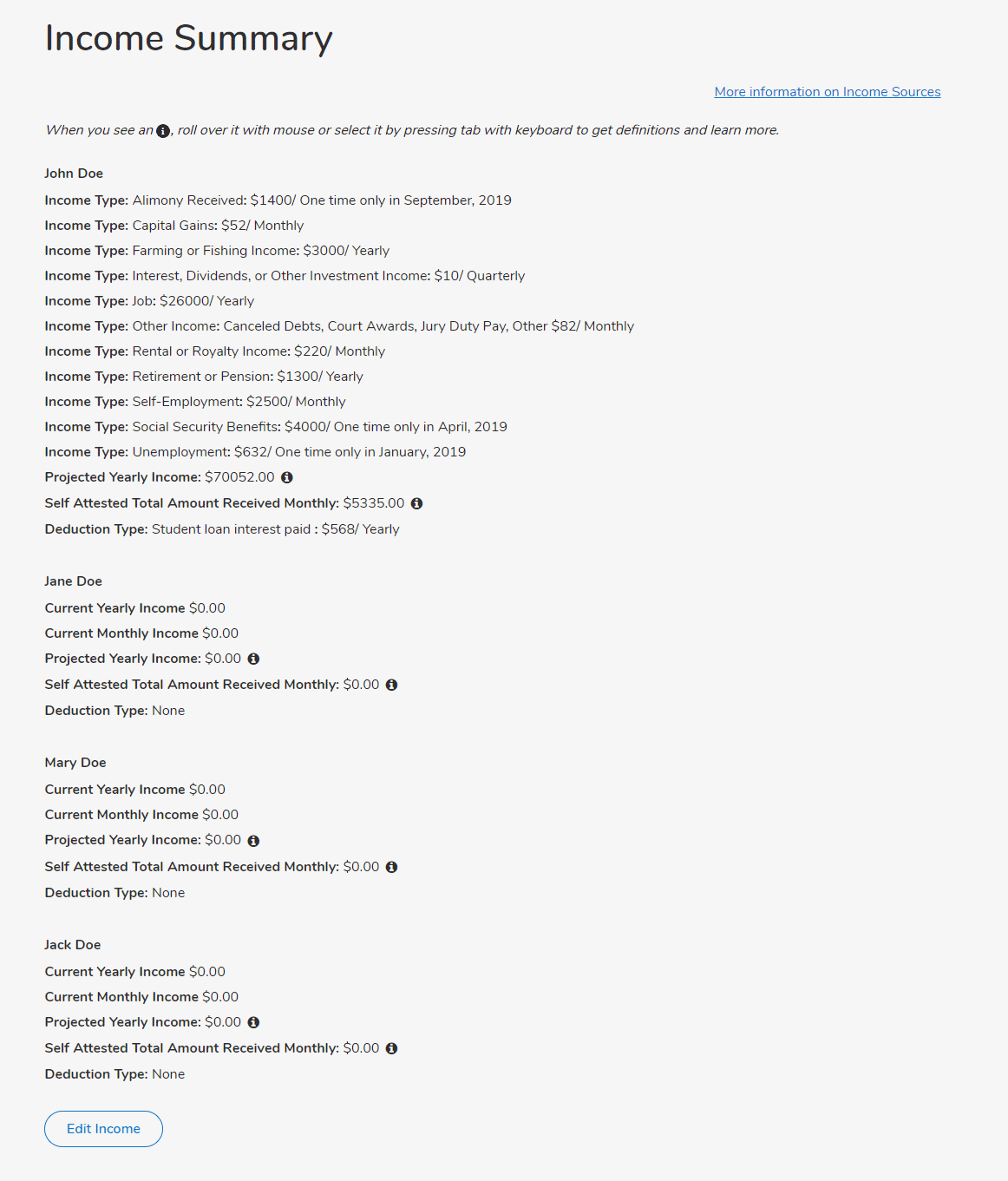

Income Summary

The information on the Income Summary will list all income received for the members of the household.

If there is monthly income available, monthly will be shown. If there is no monthly income, the projected annual income will be shown.