Health coverage and your 2024 taxes:

What you need to know about health coverage and filing your taxes

Overview

If you or a family member were enrolled in health insurance through the Massachusetts Health Connector all or part of 2024, this may affect your federal and state income taxes. Both state and federal law require adult residents 18 years and older to have health insurance if they can afford it. Failure to have health insurance for the entire year may result in a tax penalty.

The Health Connector mailed tax Form 1095-A to all tax households who purchased health insurance from the Marketplace in 2024 to complete your income tax return.

Those who were enrolled in a Health Connector or ConnectorCare Plan all or part of 2024 should have received their IRS Form 1095-A on or around January 31, 2025 and can also sign into their account and download the form in the member portal.

![]() Form 1095-A Copies & Corrections

Form 1095-A Copies & Corrections

Need a copy of or corrected Form 1095-A? New this year: You can now sign into your account and go to the Payment Center to download a copy of your tax forms. For corrections, click the link below for more information about correction requests.

What is Form 1095-A?

Form 1095-A has information about the months that members were covered by the Health Connector. It also has information that helps the IRS determine if members should have received a premium tax credit in 2024 to help lower their health insurance premiums.

A Form 1095-A shows the IRS:

- Which months you were covered by the Health Connector

- Information about the amount of Advance Premium Tax Credit you received in 2024, if any

- Information that can you can use to claim a tax credit, if you qualify

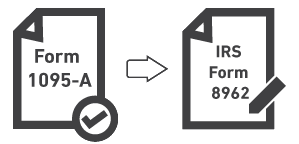

If you want to claim a premium tax credit for 2024 and you’re filing your taxes by paper, you’ll use the information from your Form 1095-A to fill out IRS Form 8962 and include with your tax return. If you’re filing with online tax filing software, you’ll use the information from your Form 1095-A to answer questions for Form 8962.

What other health insurance forms will you get?

If you had health insurance through the Health Connector in 2024, you should expect to get:

| Form | 1095-A | 1099-HC |

|---|---|---|

| Sent by… | Health Connector | Your insurance company |

| Use it for… | Federal income tax return | State income tax return |

You may get more forms if you also had health insurance through another source in 2024, such as a job or public health insurance program.