Frequently Asked Questions

This information does not, and is not intended to, provide legal, tax, or accounting advice to employers. The information provided here is general in nature and based on authorities that are subject to change. Readers should consult with their tax advisors concerning the application of tax laws to their particular situations.

FAQs About Health Connector for Business

What are the benefits of using Health Connector for Business for my small business?

Health Connector for Business offers a tailored, flexible, and affordable approach to employee health coverage for small businesses in Massachusetts.

Since our business platform only serves employers with 50 or fewer employees, the Health Connector understands the unique needs of small businesses and can tailor coverage solutions for small business owners. Through online tools, we make it easier for employers to compare private health insurance plan options and manage employee benefits. Insurance brokers are also available to assist employers at no cost.

Employers have flexibility through Health Connector for Business to either pick one plan for all employees or, through our innovative employee choice models, allow employees to shop from a range of plans while still controlling employer costs. For more information about our choice models, please visit the our employee choice page. Employees can compare their options across the full insurance market. Participating insurers include:

- AllWays Health Partners

- Blue Cross Blue Shield of Massachusetts

- Boston Medical Center HealthNet Plan

- Fallon Health

- Harvard Pilgrim Healthcare

- Health New England

- Tufts Health Plan, and

- UnitedHealthcare

Small businesses participating in Health Connector for Business save money. On average, small businesses spend over 20 percent less just by being able to easily compare different insurance carriers when shopping through our platform when compared to shopping off-exchange where it can be harder to easily comparison shop. We also offer exclusive savings such as a wellness rebate program, ConnectWell, which offers up to 15 percent in additional savings for eligible employer groups. Employers that participated in our ConnectWell rebate program received an average rebate of $3,200 in plan year 2019. For additional information about ConnectWell, please visit Health Connector for Business ConnectWell page. In addition, there are no membership fees or dues required for an employer to offer coverage through our platform.

All plans offered through the Health Connector offer peace of mind because they are compliant with state and federal law, meet state requirements for your employees to have minimum credible coverage, and have the Health Connector’s “Seal of Approval” for quality and value.

Is my small business eligible to enroll with Health Connector for Business?

Massachusetts-based businesses with 1 to 50 eligible employees can shop for and purchase coverage through Health Connector for Business if they meet eligibility criteria. Please see the Health Connector for Business’ Eligibility and Verification Policy for details on how to determine your eligibility. Before submitting an application, an employer group will need to provide us with documentation to confirm its eligibility.

What happens if my small business grows to over 50 employees?

If your company offers coverage to employees through Health Connector for Business and grows to over 50 eligible employees, your business can continue to be eligible to obtain coverage for your employees through our platform as long as all other eligibility requirements are met.

If I am the business owner and don’t have any non-family employees, can I purchase coverage through Health Connector for Business?

No, employers can only use Health Connector for Business if they have at least one eligible non-owner employee enrolled/or who needs . Under federal rules, business owners and their spouses/families, partners in a partnership and their spouses, and temporary workers and substitutes are among those individuals not included as eligible employees for the purpose of determining employer size. Please review the Health Connector for Business Eligibility and Verification Policy for details about how your employee composition and corporate status may affect your eligibility.

If you don’t qualify to use Health Connector for Business because you are self-employed without eligible employees, you can still access coverage through the Health Connector for individuals & families. You may be eligible for subsidies depending on your income and a range of other factors.

Learn about eligibility, enrollment periods, and to shop for coverage →

If I’m a business owner without employees who hires an employee during the year, can I enroll in Health Connector for Business mid-year?

Yes. Because our enrollment is rolling throughout the year, a business owner with an employee can create an account and sign up for coverage to begin on the first of any month during the year. Once the employer group has become eligible, the business owner can choose to participate in the same small group coverage on the Health Connector for Business platform at the same time as the new employee.

What are Health Connector for Business’s participation and contribution requirements?

In order for small groups to offer coverage through Health Connector for Business, at least one part-time or full-time employee must enroll on the effective date of coverage, and the participation rate at the time of enrollment must be at least 75 percent (that is, 75 percent of eligible employees must either accept small group coverage or have a Valid Waiver). In addition, employers must offer coverage to all full-time employees (30 hours per week). At a minimum, employers are required to contribute 50 percent towards the cost of the premium for an individual employee, and 33 percent towards the cost of the premium for any covered spouse, domestic partner, or child.

Groups that are not able to meet minimum contribution or participation requirements are only eligible to shop for coverage during the annual small group open enrollment period (November 15 through December 15) with an enrollment start date of January 1.

For details on requirements that may apply to your small business, please see Health Connector for Business Contribution and Participation Policy.

How do I find a plan that meets my business’s needs?

Health Connector for Business’s online tools makes it easy to compare options for your employees. You can shop online or use an insurance broker at no cost to find a plan that best reflects the needs of your business. Some options allow employees to select from a range of plans to best meet their needs. In addition, Health Connector for Business has a “window shopping” tool that makes it easy for employers to anonymously preview plans available through Health Connector for Business and get a quote, without the need to create an account. For more information about finding the right health and dental plans for your business, please visit our employer webpage.

What are your timelines to enroll?

Generally, new employers can sign up at any time of the year, with coverage starting the next month. Please see Health Connector for Business specific employer application deadlines, depending on your desired effective coverage date. In addition, please see “What are Health Connector for Business’s participation and contribution requirements?” above.

Are there any membership fees to buy coverage for my employees through Health Connector for Business?

No. There are no membership fees or dues required for employers to purchase coverage for their employees through Health Connector for Business.

Can I work with a broker?

Yes. Through Health Connector for Business, you have access to insurance brokers who are available to assist you at no cost. To find a local broker who is trained and certified to help you use Health Connector for Business, please visit our certified broker directory →

If I’m an employer based in Massachusetts, but my employee lives out of state, can the employee still receive Health Connector for Business coverage?

Yes. We offer out-of-state coverage via our Preferred Provider Organization (PPO) plans. To access a PPO plan, employers should select the “One Carrier” model of plan shopping. For more information on the “One Carrier” model, please visit the Health Connector for Business Employee Choice page.

Can I offer dental coverage to my employees through Health Connector for Business?

Yes. Employers that offer health insurance plans through Health Connector for Business can choose to add dental plans for their employees. Please visit our Health and Dental Insurance Carrier page for more information about dental carriers.

If an employer offers both health and dental coverage to their employees, an employee does not need to enroll in health care coverage in order to enroll in dental. The employee can choose to waive the health benefit and enroll in the dental benefit only.

Can I offer coverage to part-time employees? And if so, how much do I have to contribute to part-time employees’ coverage?

Yes, you can offer coverage to part-time employees (employees working less than 30 hours per week). Employers can shop through the Health Connector if they have 1 to 50 eligible employees (which includes both full-time and part-time non-owner employees). If you offer coverage to part-time employees, you must contribute a minimum of 50 percent towards the cost of the premium for an employee-only (individual) plan and a minimum of 33 percent towards the cost of a premium for any dependent or family member plan (same contribution percentages as for full-time employees). Minimum contribution and minimum participation requirements do not apply for groups enrolling during the annual small group open enrollment period.

Employers should be aware that there are other legal requirements that apply to how they choose to make contributions towards employee premiums. Please review the “Nondiscrimination” section of the Employer Contribution and Participation policy for additional information.

Can I offer coverage to a contractor or 1099 employee?

A “1099 employee” is an independent contractor and is not counted for the purposes of determining group size for Health Connector for Business eligibility and are not eligible for small group coverage.

Do you have Health Savings Account (HSA) compatible plans?

Yes. Each Health Connector for Business carrier offers a Silver-level HSA-compatible plan and some offer a Bronze-level HSA-compatible plan. An HSA is a tax-advantaged medical savings account available to taxpayers who are enrolled in a qualifying high deductible health plan (HDHP). Employees can use this type of savings account to save pre-tax funds in order to pay for qualified medical expenses, reducing out-of-pocket expenses, such as for prescription drugs or co-payments. Individuals and families can fund their HSAs up to specific limits set by the Internal Revenue Service (IRS). For more detailed information about HSAs, please see IRS publication 969 and IRS publication 502.

If I choose a plan that is HSA-HDHP compatible, how do I set that up and what do I need to know?

Health Connector for Business cannot help you set up an Health Savings Account (HSA); however, you can usually set up an HSA at a financial institution, like a bank. In addition, carriers may offer guidance about how to set up and maintain an HSA or how to find an HSA administrator. To learn more about HSAs, go to IRS.gov and type “HSA” in the search tool.

How does Health Connector for Business coverage work for my employees who are Medicare eligible or retirees?

Becoming eligible for Medicare is a qualifying life event (QLE) and an employee should add this information to their Health Connector for Business account in order to end their coverage through their employer. While policies and contracts among employers and carriers may differ, our platform does not automatically end a member’s coverage upon their turning 65 on account of Medicare eligibility. Our system is able to end their coverage if the employer has a policy to do so, but a member’s coverage will not automatically end.

FAQs about Options for Small Businesses to Manage Health Coverage Affordability

What are Health Connector for Business’s Employee Choice Models?

Employers can select different ways to offer coverage to their employees through Health Connector for Business. Employers can choose to offer either:

-

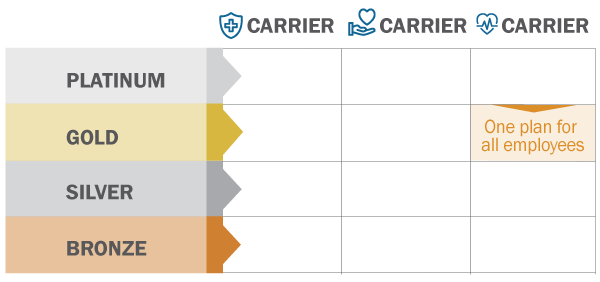

- One Plan: the employer chooses a plan and the company contribution amount. All employees can enroll in that one plan.

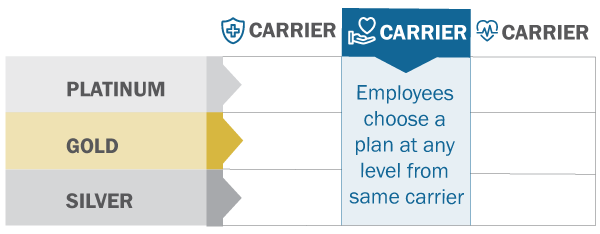

- One Carrier: the employer chooses an insurance carrier and company contribution amount. Employees can compare and choose a plan from that carrier at any benefit level to best meet their health care needs.

- One Plan: the employer chooses a plan and the company contribution amount. All employees can enroll in that one plan.

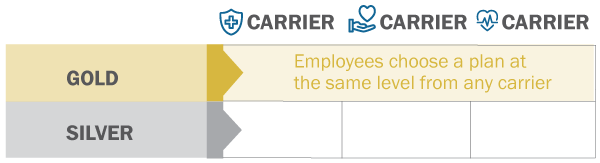

- One Level: the employer chooses a benefit level and company contribution amount. Employees can compare and choose among plans offered by a range of carriers at that benefit level.

With the option to select one plan, one carrier, or one level, Health Connector for Business is the only place in the small group market where small businesses can offer this degree of choice and flexibility to their employees. Please visit our Employee Choice page for more information.

How can I save 15 percent on premiums with ConnectWell?

ConnectWell is Health Connector for Business’ wellness rebate program that benefits both employers (with up to 25 employees) and their employees. If your group qualifies, employers can receive a 15 percent rebate on their contributions towards premiums for the plan year if one-third (33 percent) of their employees participate. Employees who participate in a qualified activity earn a $100 Visa gift card. Get more information about ConnectWell →

How can the Small Business Health Care Tax Credit help me save money and who is eligible to receive it?

Massachusetts-based small businesses can only claim the federal Small Business Health Care Tax Credit established under the Affordable Care Act if they buy coverage through Health Connector for Business. Since we are Massachusetts’s Small Business Health Options Program (“SHOP”), only small business employers that buy coverage through Health Connector for Business can apply for and claim this tax credit on their federal taxes.

The Small Business Tax Credit is worth up to 50 percent of for-profit employers’ annual premium contributions and up to 35 percent for tax-exempt employers’ annual premium contributions. In order to be eligible for the Small Business Health Care Tax Credit, businesses must:

- cover at least 50 percent of the cost of single (not family) health coverage for each employee;

- have fewer than 25 full-time equivalent employees (FTEs);

- have average annual wages per FTE that are under the limit set by the IRS each year (guidelines can be found on the most up to date IRS form 8941 and corresponding instructions); and

- shop through their state Marketplace (the Massachusetts Health Connector).

Please see the federal government’s SHOP calculator for assistance calculating Small Business Health Care Tax Credit eligibility. In addition, please see guidance from the IRS for additional information about the Small Business Health Care Tax Credit and eligibility.