ConnectorCare Plans: Affordable, high-quality coverage from the Health Connector

ConnectorCare plans have $0 or low monthly premiums, low out-of-pocket costs, and no deductibles. Plus, you may be able to fill certain prescription medicines at no cost for chronic health conditions like asthma, coronary artery disease (a type of heart disease), diabetes, and hypertension (high blood pressure).

What kind of coverage do you get with ConnectorCare?

ConnectorCare plans offer great coverage with important benefits like doctor visits, prescription medications, and emergency care. ConnectorCare plans have low monthly premiums, low co-pays, and no deductibles. There are different ConnectorCare Plan Types, which are based on your income. All of the plans offered for each Plan Type will have the same benefits and co-pays for covered services. You can see the co-pays for different services in the chart found here. You can also see examples of the monthly premiums for each Plan Type below.

ConnectorCare plans are offered by some of the leading insurers in the state. Each insurer’s plan may have different doctors or hospitals in their provider networks. Before you enroll, use our online tools to see if see if the providers you want and the prescription drugs that you need are covered in the plan’s network.

ConnectorCare plans are offered by some of the leading insurers in the state. Depending on where you live, you may be able to choose from ConnectorCare plans offered by:

- Blue Cross Blue Shield of Massachusetts

- Fallon Health,

- Harvard Pilgrim Health Care

- Health New England,

- Mass General Brigham Health Plan,

- Tufts Health Plan,

- UnitedHealthcare, and

- WellSense Health Plan

Each insurer’s plan may have different doctors or hospitals in their provider networks. Be sure to use our new Plan Finder Tool to see if your preferred providers, facilities, and prescription drugs are in a plan’s network before you enroll.

ConnectorCare Plans for Individuals & Families

What are ConnectorCare plans? Watch the video for a brief overview.

LENGTH: :56 | FULL TEXT

Who can qualify For a ConnectorCare plan?

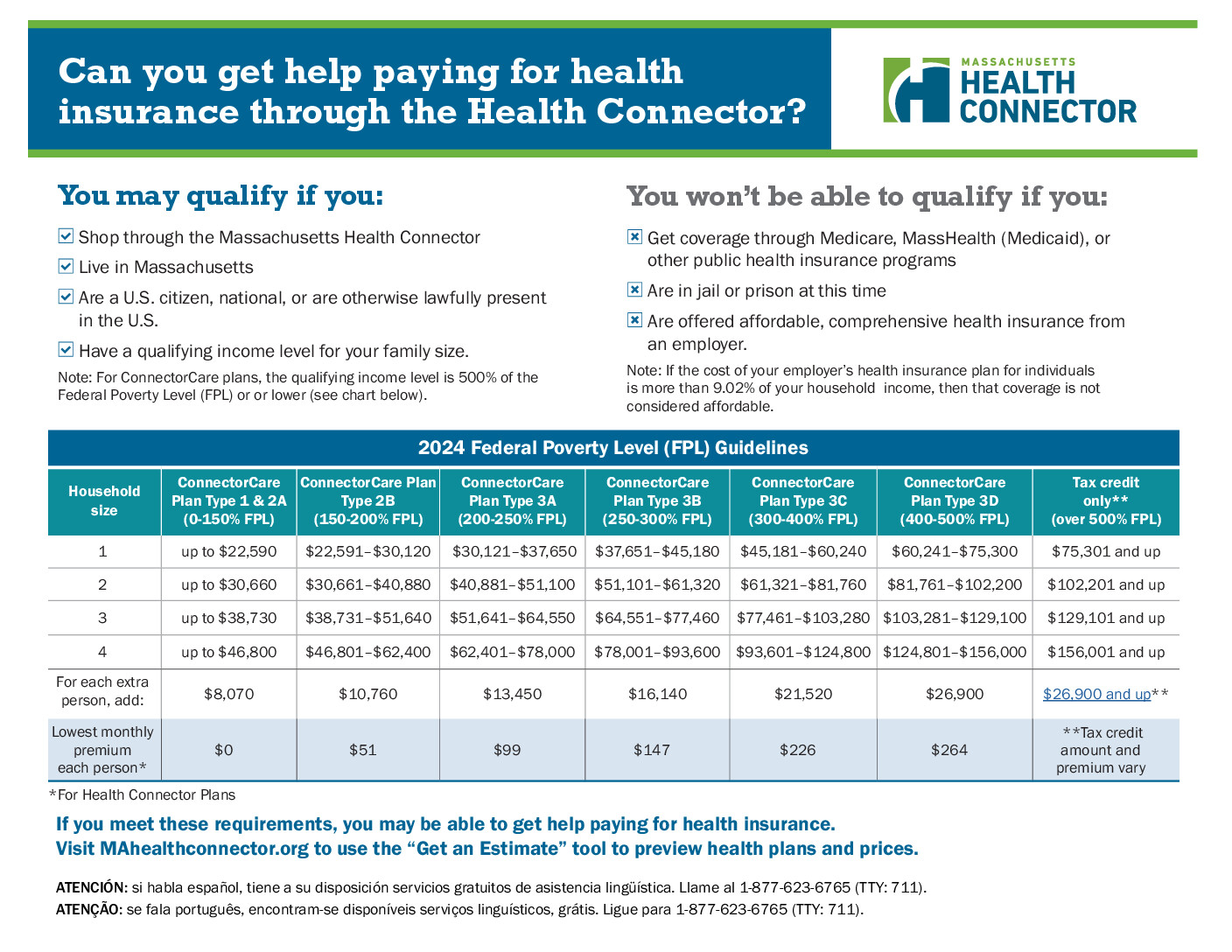

People with household incomes that are at 500% of the Federal Poverty Level (FPL) or lower may qualify for ConnectorCare. If your income is higher than income limit for the plan year, you won’t qualify for a ConnectorCare plan.

However, you may still be able to get tax credits that help to lower the cost of your monthly premiums. To qualify for a ConnectorCare plan, you will need you will also need to meet the following requirements:

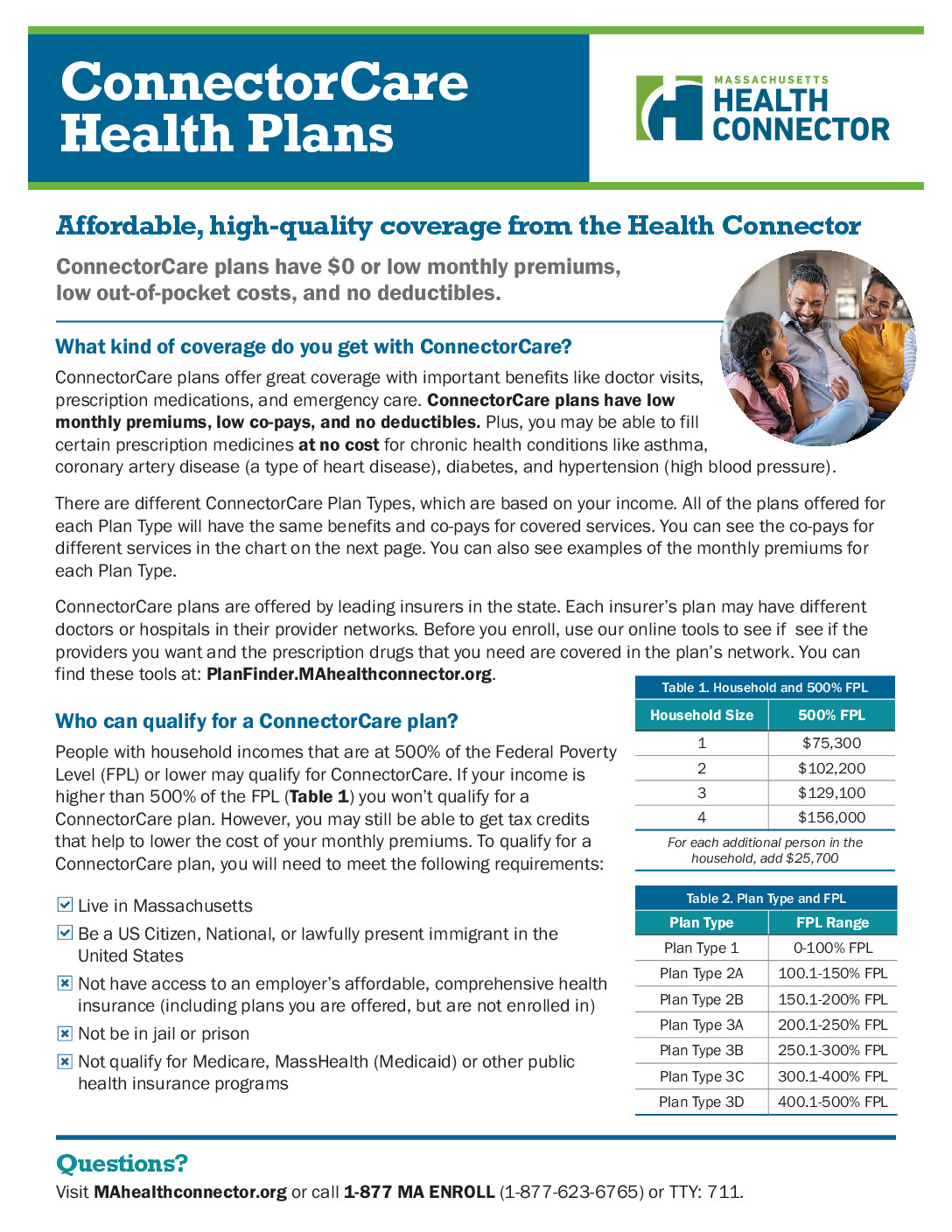

Which ConnectorCare plan can you qualify for?

The cost of ConnectorCare plans differs depending on the health insurer and the Plan Type. The Plan Type you qualify for is based on your income. The chart on the right shows the FPL ranges for different ConnectorCare Plan Types.

| Plan Type | FPL Range | 2025 Lowest-cost Monthly Premium per person |

|---|---|---|

| Plan Type 1 | 0–100% | $0 |

| Plan Type 2A | 100.1–150% | $0 |

| Plan Type 2B | 150.1–200% | $51 |

| Plan Type 3A | 200.1–250% | $99 |

| Plan Type 3B | 250.1–300% | $147 |

| Plan Type 3C* | 300.1–400% | $226 |

| Plan Type 3D* | 400.1–500% | $264 |

There are different coverage options for American Indians and Alaska Natives. American Indians/Alaska Natives may qualify for lower out-of-pocket costs through ConnectorCare plans and other Health Connector plans. Click here to learn more →

Important Resources

Frequently Asked Questions

What happens if I am not able to afford to pay my premium in full each month?

If you are eligible for ConnectorCare and can’t afford your monthly premium because your income has changed, make sure to report the change in income. By updating your income, you may be eligible for lower or no premium coverage.

To see if you qualify for a lower-cost plan, you can update your income information by

- Signing into your online account and updating your income information. Learn how →

- Calling Customer Service representative at 1-877-623-6765 (TTY 711 for people who are deaf, hard of hearing, or speech disabled), or

- Contact a state-certified Enrollment Assister. Find contact information for organizations near you →

If you are enrolled in a ConnectorCare plan and believe you are experiencing extreme financial hardship, you can apply for a Premium Waiver or Reduction. To understand what extreme financial hardship means, how to apply, and what documents you will need to send with your application, go to find out more about Premium Waiver or Reduction →